The crypto market is down today, but the situation has improved since yesterday. Nearly 30 of the top 100 coins have recorded increases over the past 24 hours. Moreover, the cryptocurrency market capitalization has decreased by 2.3% over the past day, now standing at $3.38 trillion. The total crypto trading volume is $101 billion, somewhat lower than the levels observed in the last two days.

TLDR:

Crypto Winners & Losers

Four of the top 10 coins per market cap are red and four are green today (not taking the two stablecoins into account), but most are up/down below 0.5%, meaning that they are practically unchanged.

Bitcoin (BTC) fell by 0.1%, meaning it hasn’t really changed since this time yesterday, now trading at $104,812.

Also, Ethereum (ETH) has increased by 0.1%, therefore also standing unchanged at $2,524.

XRP (XRP) saw the highest increase in this category of just 0.4%, to the price of $2.16. The highest decrease is Solana (SOL)’s 1.3% to $145.

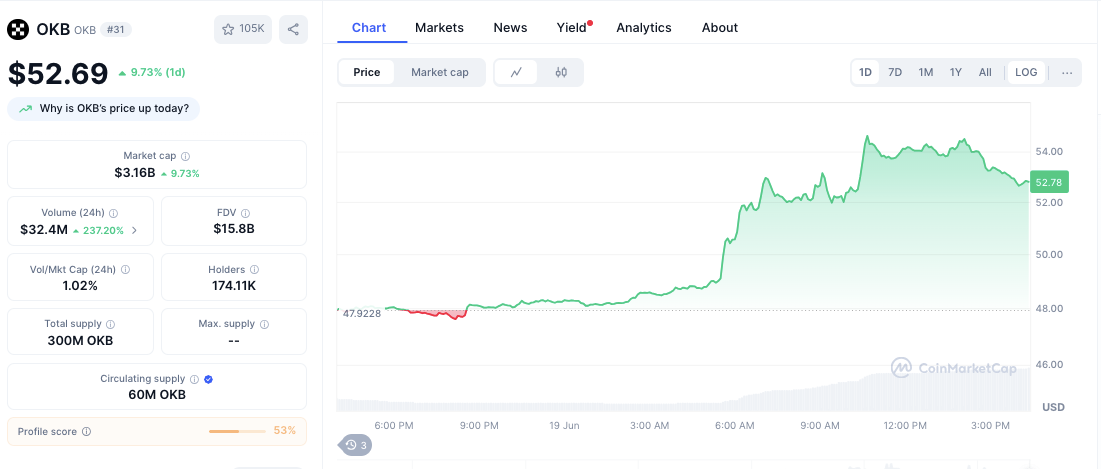

Moreover, unlike yesterday, when only two of the top 100 coins saw their prices rise, 30 have increased today. Kaia (KAIA) is the best performer for the second day in a row, having increased by 9% to $0.1779, followed by Sei (SEI)’s 7.8% to $0.1836.

At the same time, Hyperliquid (HYPE) recorded the highest decrease today, falling 5.4% to the price of $37.93.

As for Kaia (formerly Klaytn), the L1 chain announced support for USDT in May. A few days ago, it revealed that an increasing number of wallets and CEXs support USDT on Kaia.

Yesterday, the team announced Kaia Hub, saying it’s an all-in-one gateway to the chain. It’s built by Xangle, an on-chain data service and solution provider.

Inflation is Still in the Cards

Glassnode found that, unlike yesterday, funding rates have turned positive for BTC and ETH.

The US Federal Reserve held a policy meeting on Wednesday, with investors across the board paying close attention. Fed Chair Jerome Powell said that policymakers are “well positioned to wait” on rates.

Powell “noted that uncertainty has diminished and that the Federal Reserve expects inflation to move toward its target in the coming months,” commented Ruslan Lienkha, Chief of Markets at YouHodler. But “the broader macroeconomic landscape suggests that geopolitical tensions and tariff policies could still exert upward pressure on U.S. inflation.”

Rising inflation is a mixed bag for crypto. While crypto, particularly BTC, can be seen as a hedge against inflation, an increase in inflation can also result in rising interest rates. This subsequently can turn investors’ attention away from digital currencies.

Powell “aimed to reinforce confidence in the disinflationary trend,” and he “emphasized the overall strength of the U.S. economy,” Lienkha says. This “provides the Fed with the flexibility to maintain elevated interest rates for an extended period. Markets interpreted these remarks as somewhat mixed, with a potentially hawkish undertone.”

Therefore, “as a result, equity indices may enter a period of consolidation in the coming month, a dynamic that could also be reflected in Bitcoin’s price behavior.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $104,812, unchanged since this time yesterday. It has seen quite a choppy 24 hours, more turbulent than we’ve seen it in a while. It attempted to hold the $105,000 level several times, but ultimately failed.

In the same period, it fell to the $103,830 level several times, but managed to recover.

At the same time, Ethereum is currently trading at $2,524, also unchanged since yesterday. Similarly to BTC, it had had a few choppy hours before finding a more stable range over the past few fours. The price saw an intraday low of $2,471, while it also hit an intraday high of $2,541.

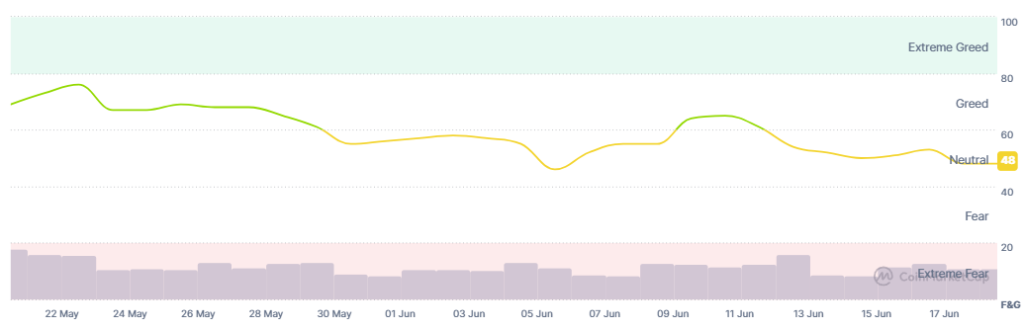

Moreover, as the market in general, the crypto market sentiment is also unchanged today. The Fear and Greed Index still stands at 48. As the fear increases, so do the buying chances, but the sentiment still has room to return to the greed territory.

Meanwhile, on 18 June, US BTC spot exchange-traded funds (ETFs) saw net inflows for the 8th consecutive day, with $389.57 million. BlackRock recorded $278.93 million, and Fidelity took in $104.38 million. The cumulative total net inflow is $46.65 billion.

At the same time, US ETH spot ETFs recorded net inflows of $19.1 million. BlackRock saw $15.11 million, and Grayscale saw $3.99 million. The cumulative total net inflow rose to $3.91 billion.

Meanwhile, Canadian digital asset firm Sol Strategies filed for listing on the Nasdaq Capital Market as part of its US market expansion strategy.

Also in the US, Senator Cynthia Lummis is putting pressure on Congress to fast-track clear crypto legislation following the Senate’s approval of the GENIUS Act on Tuesday. While this approval brought the country “one step closer to being a welcoming home for digital assets,” Congress still needs to pass market structure legislation as a whole in order to make the US the global “crypto capital,” Lummis argued.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has been red over the last day, while the stock markets have seen quite a mixed picture. The S&P 500 went down by 0.031%, the Nasdaq-100 increased by 0.0028%, and the Dow Jones Industrial Average fell by 0.1%. This is the response to the US Federal Reserve not changing interest rates as economic uncertainty persists. Investors continue to monitor developments in the Middle East.

- Is this dip sustainable?

The dip may continue over the short term, based on the current geopolitical and economic turbulence. A continuation of the rally is possible, prompted by regulatory developments, but the overall global situation may drag the prices lower as investors seek stable footing.

The post Why Is Crypto Down Today? – June 19, 2025 appeared first on Cryptonews.

#Crypto #Today #June

Dive in:

Dive in: