The crypto market is down today again. The majority of the top 100 coins per market cap and all top 10 coins saw their prices decrease over the past 24 hours. At the same time, the cryptocurrency market capitalization has fallen 3.8% to $3.42 trillion. The total crypto trading volume is at $87.3 billion.

TLDR:

Crypto Winners & Losers

In contrast to yesterday, the prices of all the top 10 coins per market cap have dropped today. However, only two fell above 0.5%, meaning that the majority of the coins in this category are practically unchanged.

Bitcoin (BTC) fell 0.4%, currently trading at $108,322. This is still largely unchanged over the past five days.

At the same time, Ethereum (ETH) fell by 0.3%, currently changing hands at $2,558.

The only two coins with increases above 0.5% are Dogecoin (DOGE) and Solana (SOL), with a drop of 2.5% and 1.3% to the price of $0.1682 and $149, respectively.

When it comes to the top 100 coins, about a dozen are up at the time of writing. Bonk (BONK) is the best performer today. It’s up 6.8% to $0.00002347.

POL (POL) is up 1.7% to $0.1868, while the rest are up below 1% each.

On the other hand, Fartcoin (FARTCOIN) and SPX6900 (SPX) fell the most in this category. They’re down 7.7% and 6.8% to the prices of $1.08 and $1.24, respectively.

Financial markets in general reacted to US President Donald Trump’s letters to several countries, threatening tariffs of 25%-40% and reigniting global trade war fears. Notably, he accused Japan and South Korea of unfair trade practices, and he warned of new 25% duties. The new deadline is 1 August.

That said, stocks were far more impacted than crypto.

Meanwhile, Ethereum co-founder Vitalik Buterin has argued that the crypto community should turn to “copyleft” licensing. He says that the sector is drifting away from its open-source roots.

“The crypto space in particular has become more competitive and mercenary,” Buterin wrote. “We are less able than before to count on people open-sourcing their work purely out of niceness. […] Copyleft can be viewed as a very broad-based and neutral way of incentivizing more diffusion.”

‘Broader Mix of Market Signals’

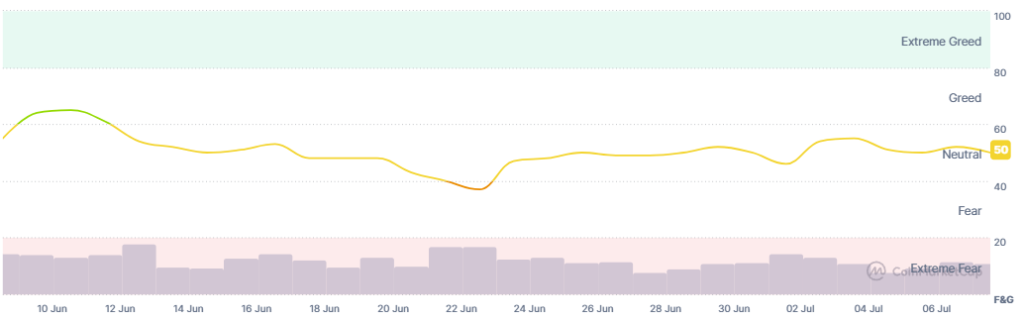

James Toledano, Chief Operating Officer at Unity Wallet, commented that Bitcoin surged to a record June closing at $107,100 and experienced its strongest week above $109,200, but “the ‘neutral’ reading reflects a broader mix of market signals.”

“While institutions have been piling in, a lot of money is quite tentative right now as the world appears to be on a knife’s edge both geopolitically and macro-economically.”

The index factors include volatility, trading volume, options activity, social‑media sentiment, Bitcoin dominance, and search‑trend data, Toledano says.

“Price momentum may be strong, but muted volume and rising volatility suggest caution.”

“Meanwhile, high hedging activity or increased wary sentiment on social media and search trends could also dampen greed. In short, while prices rally, underlying metrics still reflect mixed investor sentiment,” he concluded.

Moreover, following EthCC 2025, Alexei Zamyatin, BOB Co-Founder and BitVM researcher, commented that the conference made “one thing clear: the lines between traditional finance, the DeFi ecosystem, and Bitcoin are blurring faster than ever.”

He continued: “From Robinhood’s tokenized equities to modular rollups and decentralised AI, the event showcased the accelerating convergence of these once-distant worlds. The growing interest in Bitcoin DeFi was also unmistakable, a sign that even at Ethereum’s flagship event, Bitcoin is taking its place at the forefront of the conversation.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $108,322. The price first increased to the intraday high of $109,056 but then swiftly dropped to $107,591. It has slightly recovered to the current price since.

Moreover, Ethereum is currently trading at $2,558. It started the day with a daily high of $2,581 and then fell to $2,521, before rebounding to the current level.

Meanwhile, the crypto market sentiment continues moving between 49 and 55 over the week, though it has been dropping towards the fear zone in the past two days. The Fear and Greed Index fell from 52 yesterday to 50 today. Nonetheless, there is no panic in the market, with both the sentiment and the prices moving sideways.

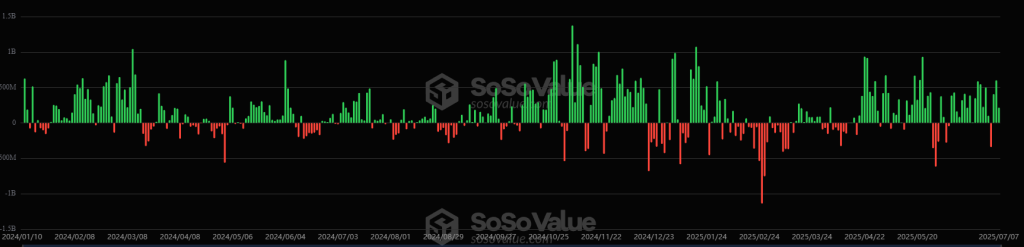

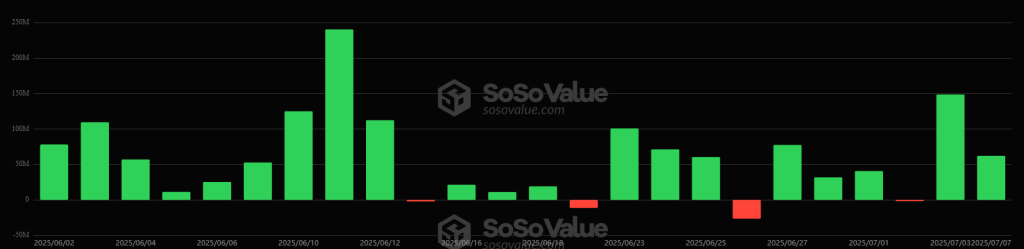

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded inflows of $216.64 million on 7 July. BlackRock leads the list with inflows of $164.64 million. Fidelity and Grayscale (BTC) also recorded positive flows, while Grayscale (GBTC) and Ark 21Shares saw outflows.

On the same day, US ETH ETFs saw inflows of $62.11 million. BlackRock and Fidelity were responsible for the entire amount.

Furthermore, Murano Global, a Nasdaq-listed real estate company and a hotel chain in Mexico, has become the latest company to reveal its Bitcoin treasury initiative, buying 21 BTC. It entered into an equity agreement of up to $500 million with Yorkville, with the proceeds “primarily” earmarked for BTC purchases.

Also, the Dubai Financial Services Authority (DFSA) granted approval to the QCD Money Market Fund (QCDT), the region’s first tokenized money market fund jointly launched by Qatar National Bank (QNB) and DMZ Finance.

The product is designed to bring traditional instruments like US Treasuries on-chain and to enable use cases such as stablecoin reserves, Web3 payment systems, exchange collateral, and institutional liquidity tools.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market fell mildly over the past 24 hours, while the US stock market dropped sharply by closing time on Monday. The S&P 500 fell by 0.79%, the Nasdaq-100 also dropped by 0.79%, and the Dow Jones Industrial Average decreased by 0.94%. Stocks reacted to a number of tariffs and global trade news. Notably, the US has sent out official letters to several countries announcing levies ranging from 25% to 40%.

- Is this dip sustainable?

The market has been consolidating for a while now. Analysts expect periodical dips to continue, but they argue that the market will overall increase by the end of this year.

But what else is happening in crypto news today? Follow our up-to-date live coverage…

The post Why Is Crypto Down Today? – July 8, 2025 appeared first on Cryptonews.

#Crypto #Today #July