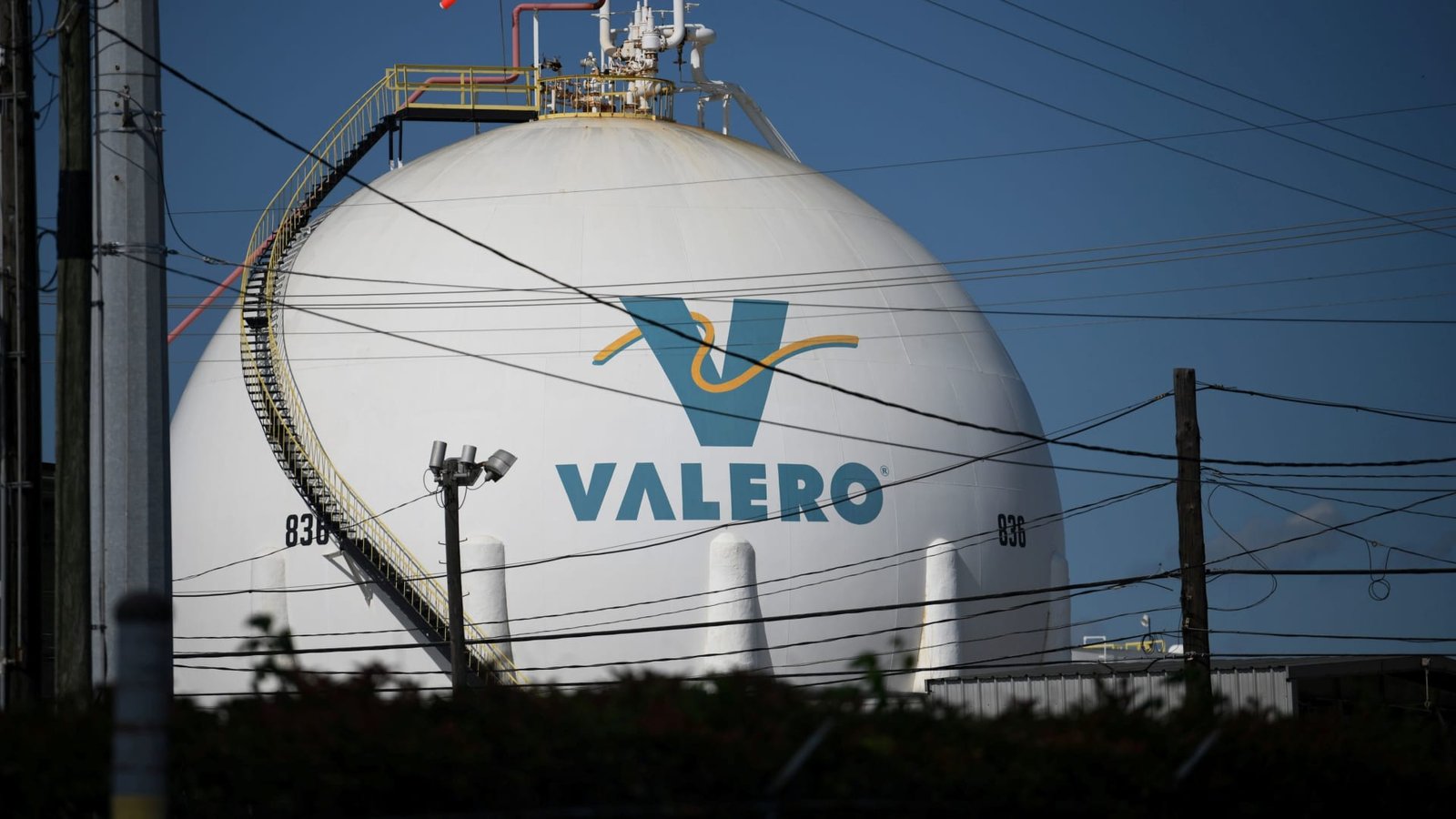

Stocks @ Night is a daily newsletter delivered after hours, giving you a first look at tomorrow and last look at today. Sign up for free to receive it directly in your inbox. Here’s what CNBC TV’s producers were watching as the Dow Industrials dropped nearly 300 points, and what’s on the radar for the next session. Ahead of the Fed: Bonds in the U.S.A. The Federal Reserve’s rate decision comes at 2 p.m. ET. Watch the action live on CNBC’s ” Power Lunch .” CNBC’s senior economics reporter Steve Liesman will have the news, and Kelly Evans and Brian Sullivan will take you through the market reaction. The U.S. 30-year Treasury bond yield is at 4.89%. The 20-year Treasury yield is at 4.91%. The 10-year Treasury note yield is 4.39%. The two-year Treasury yield is 3.95%. The one-year Treasury bill yield is 4.1%. The six-month T-bill yields about 4.31%. The three-month T-bill yields 4.33%. The two-month T-bill is yielding 4.43%. The one-month T-bill yield is 4.18%. The Fidelity Corporate Bond ETF (FCOR) is yielding 4.46%. The iShares National Muni Bond ETF (MUB) is yielding 3.14%. US10Y YTD mountain U.S. 10-year Treasury yield in 2025 High-yield bond ETFs The SPDR Bloomberg High Yield Bond ETF (JNK) is yielding 6.63%. The iShares iBoxx High Yield Corporate Bond ETF (HYG) is yielding 5.85%. The iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is yielding 7.13%. The BondBloxx CCC Rated USD High Yield Corporate Bond ETF (XCCC) is yielding 10.49%. The BondBloxx BB Rated USD High Yield Corporate Bond ETF (XBB) is yielding 5.83%. Oil and energy Energy was the only S & P 500 sector that was positive on Tuesday. The sector has been busy due to fears that Iran could affect oil prices by closing the Strait of Hormuz amid the ongoing conflict in the Middle East. In the last five trading sessions, both West Texas Intermediate crude futures and Brent crude futures are up around 15%. Gasoline futures are up roughly 10% in a week and so are natural gas futures . The big nat gas stocks are the leaders in the sector over the last week. EQT is up 9.6% in a week, hitting a new high on Tuesday. APA is up 8% in a week, but shares are still off 40% from the high reached last summer. Exxon Mobil is up 6.3% in a week. The stock is down 10% from a high. Valero is up 7.5% in a week. It’s off 15% from the high. Phillips 66 is up nearly 5% in a week. Shares are down 17% from the high. Chevron is up almost 4% in a week. It’s 12% from the March high. ConocoPhillips is up 4.7% in a week. Shares are down 20% from last summer’s high. EQT 5D mountain EQT shares in the past five sessions Energy and the President Donald Trump’s bill CNBC TV’s Emily Wilkins will look at potential winners and losers in the sector based on President Trump’s bill. We just ran through some of the old-line energy plays. The Invesco Solar ETF (TAN) dropped 9% on Tuesday. It is 30% from the June 2024 high. Sunrun plummeted 40%. The stock is off 75% from the August high. SolarEdge plunged 33% Tuesday. It is 61% from last summer’s high. Enphase fell about 24%. It is 73% from where it stood last August. The Big Seven They all dropped on Tuesday. Tesla fell 3.88%. The stock is off 35% from the 52-week high hit in December. Apple fell 1.4%. The stock is down 25% from the post-Christmas high. Amazon is down 11% from the February high. Alphabet is 15% from the February high. Nvidia is 6% from the January high. Microsoft is just off the high. Meta Platforms is down 6% from the February high.

#Whats #move #market