Last Updated:July 06, 2025, 09:30 IST

One of the key proposals in the act that may directly impact the Indian diaspora residing in the US is the imposition of remittance tax at the rate of 3.5 per cent.

The tax may also test the limits of the India-US Double Taxation Avoidance Agreement (DTAA). While some argue the proposed levy violates the DTAA’s non-discrimination clause, others believe the clause only covers income tax—not excise or transactional levies.

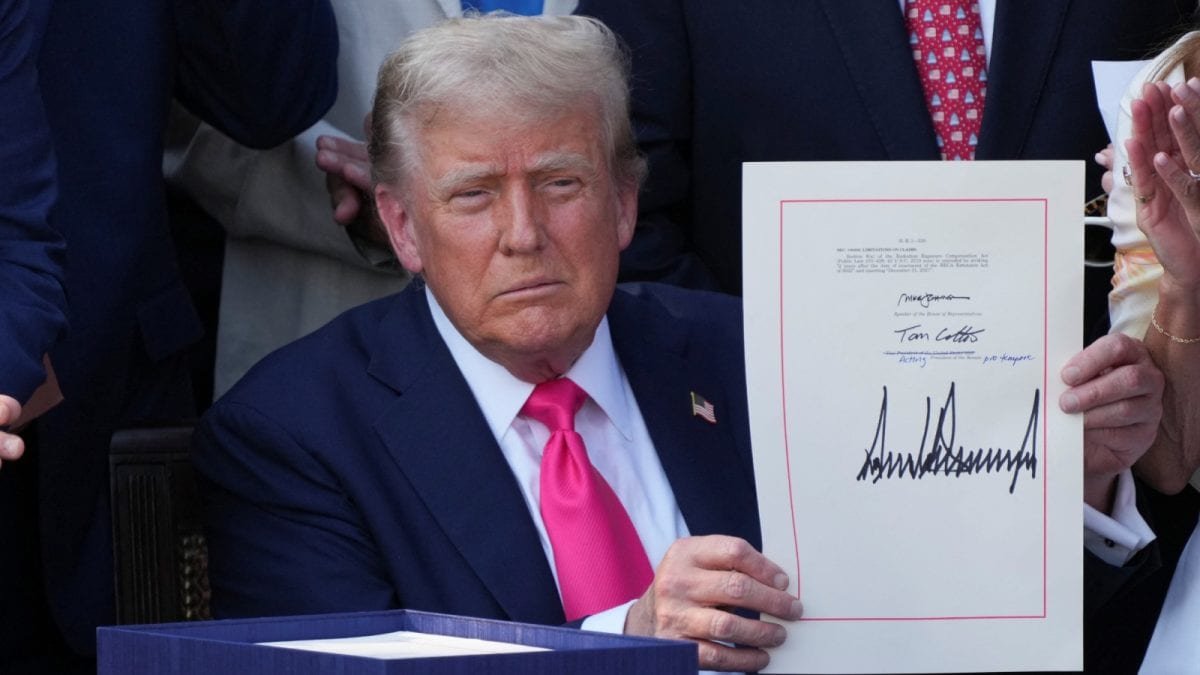

One Big, Beautiful Bill Act: Despite staunch protests and opposition, the controversial piece of legislation ‘One Big, Beautiful Bill Act’, strongly backed by US President Donald Trump, has now become a law, bringing sweeping reforms including major tax changes, welfare cuts, defence spending hikes, and cultural policy.

The bill had been passed by both the US Senate and the House of Representatives. Later, it was signed into law by President Trump at a ceremony held on July 4, during Independence Day celebrations at the White House.

One of the key proposals in the act that may directly impact the Indian diaspora residing in the US is the imposition of remittance tax. Thereupon, NRIs living in the US on H1B, L1, F1 visas, and even Green Card holders will have to pay an Excise tax on remittances at the rate of 3.5 per cent (earlier proposed to 5 per cent), making it costlier to send money.

“The proposed tax will significantly affect Indian immigrants who send money to support families in India,” said Bikramjit Bedi, Partner – Taxation, ASA & ASSOCIATES LLP. He noted that the added burden may deter many from continuing regular remittances, potentially impacting India’s foreign exchange inflows.

These individuals frequently remit funds to support their families back home. Experts warn this could lead to a decline in the overall volume of remittances.

In FY24, India received nearly $33 billion in remittances from the US, according to RBI data—almost 28% of the total $118.7 billion in remittances received. A drop in this figure could impact household incomes and consumption levels in India.

Complex Compliance And Legal Ambiguity

Another layer of concern is the lack of clarity on whether taxpayers can claim credits for the remittance tax. “India has a similar TCS provision, but offers relaxations based on purpose. The US tax, however, offers no such relief,” Bedi pointed out.

The tax may also test the limits of the India-US Double Taxation Avoidance Agreement (DTAA). While some argue the proposed levy violates the DTAA’s non-discrimination clause, others believe the clause only covers income tax—not excise or transactional levies.

Deepashree Shetty, Partner – Global Employer Services, BDO India, said the tax could impose not just financial pressure but also added paperwork. “Remitters may face enhanced scrutiny, as banks would need to report data like nationality, remittance amounts, and tax paid,” she explained.

She added that given their temporary stay, individuals on such visas rely heavily on remittances. “The tax would be an additional charge, reducing the net amount that reaches families back home,” she said.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

- First Published:

#Big #Beautiful #Bill #Act #Law #Impacts #NRIs #SendingMoneyToIndia #Business #News