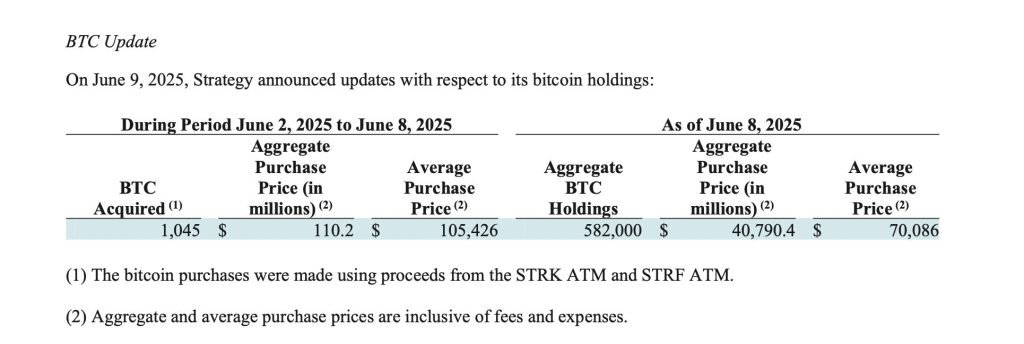

Strategy, led by Executive Chairman Michael Saylor, announced on Monday that it has once again increased its Bitcoin holdings, acquiring 1,045 BTC for approximately $110.2 million.

This latest purchase, disclosed in a U.S. Securities and Exchange Commission (SEC) filing on June 9, 2025, was made at an average price of $105,426 per coin, just as Bitcoin flirts with its all-time high (ATH).

The move marks the ninth week the company has added to its Bitcoin reserves, continuing its aggressive accumulation strategy.

Strategy’s Bitcoin Trove Now Valued at Over $40B

With this latest buy, Strategy’s total Bitcoin holdings have reached about 582,000 BTC. The company has spent approximately $40.79 billion to amass its crypto treasury, with an average purchase price of around $70,086 per Bitcoin.

As BTC trades near its record highs, Strategy’s holdings are not only historic in size but potentially highly profitable—especially given the company’s early and consistent buying behavior through various market cycles.

The firm’s commitment to Bitcoin, initially spearheaded by Executive Chairman Michael Saylor, has transformed it into the largest corporate holder of the digital asset. Strategy’s BTC approach has become a core part of its identity, drawing both institutional interest and market scrutiny.

Institutional Confidence Grows as Crypto Matures

This recent acquisition suggests more than just bullish sentiment—it reflects a broader institutional confidence in Bitcoin’s long-term value proposition. Strategy’s ongoing accumulation suggests it views BTC as a strategic treasury asset, comparable to digital gold.

By continuing its at-the-market offering programs and funneling proceeds into Bitcoin, the company is effectively doubling down on its bet that Bitcoin will continue to appreciate and outperform traditional assets over time.

As the crypto market matures and regulatory clarity slowly improves, Strategy’s moves may inspire other firms to adopt similar treasury allocation models.

Saylor’s Cryptic ‘Send More Orange’ Message

On Sunday, Saylor posted a chart of the company’s BTC holdings, saying that Strategy plans to increase its Bitcoin purchases. “Send more Orange,” his message read, as Orange is widely recognized as a symbol for Bitcoin among the crypto community.

Saylor has a history of posting on Sundays before his Bitcoin purchases. However, a recent report from K33 Research revealed that Strategy, formerly MicroStrategy, appears to have slowed down its Bitcoin buys. K33 Head of Research Vetle Lunde attributed this to a declining premium for MSTR shares relative to the company’s Bitcoin holdings.

The post Michael Saylor’s Strategy Scoops 1,045 BTC for $110M – Trove Tops $40B Near Record Highs appeared first on Cryptonews.

#Michael #Saylors #Strategy #Scoops #BTC #110M #Trove #Tops #40B #Record #Highs