$LINK is coiled for a breakout—but which way? Chainlink’s token teeters at $13.59 as a tightening symmetrical triangle clashes with a looming double top, leaving traders in limbo. With $587 million in staked collateral backing it, the next move could spark volatility.

While traders watch the charts, Chainlink continues to grow behind the scenes. Its tech now powers big names like Mastercard and JP Morgan, proving its real-world use. Will the price finally catch up? At press time, $LINK exchanges hands at $13.52.

Chainlink ($LINK) Hits ATH Holders as Mastercard & JP Morgan Adopt Its Tech – What’s Next?

Chainlink, a decentralized oracle network that securely connects smart contracts with real-world data, continues to expand its role as a critical infrastructure layer for both decentralized and traditional finance.

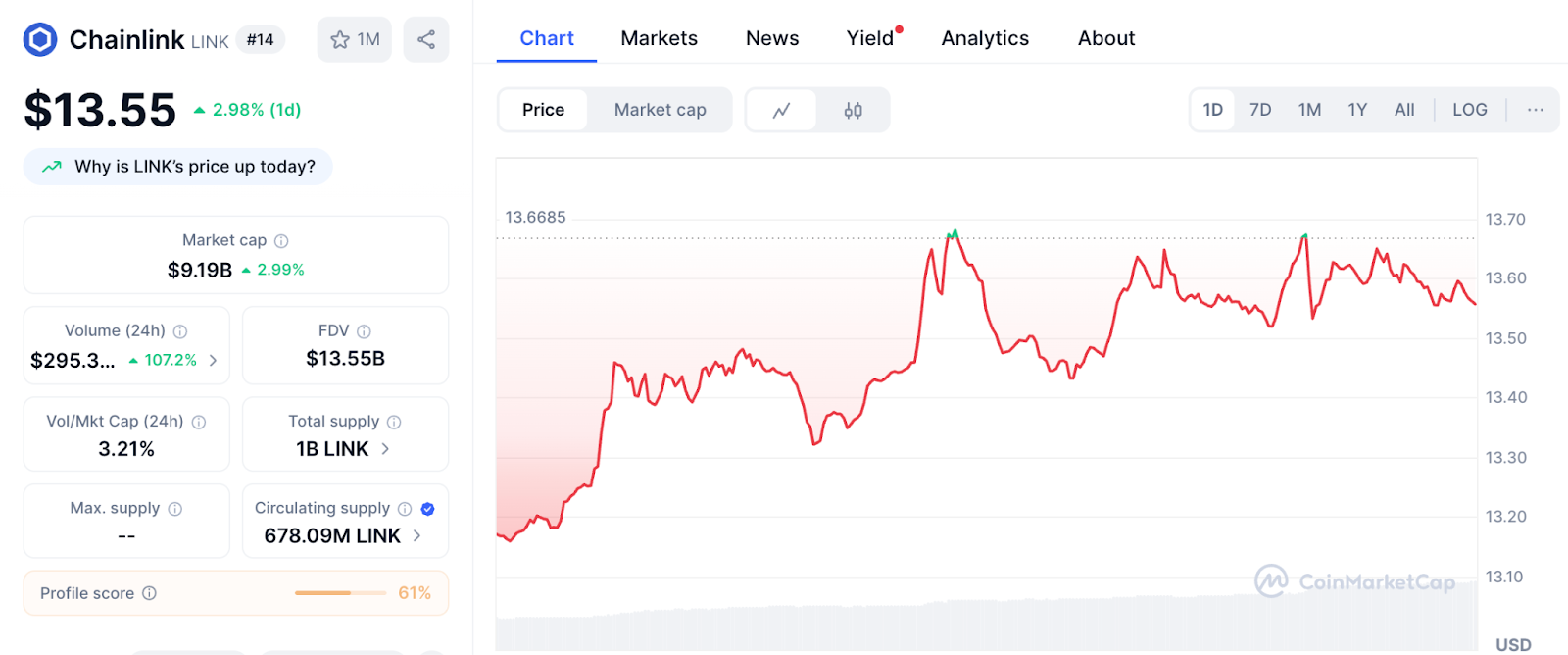

With a circulating supply of 678.09 million $LINK and a market cap of $9.19 billion, Chainlink’s recent developments highlight its growing institutional adoption.

While daily active addresses fell from 11,000 to about 3,950 in April, reflecting a natural cooling-off period after peak activity, long-term confidence in $LINK remains strong.

By late June, the number of holders had reached an all-time high of 769,380, even as the number of active wallets declined by 17.3%. This suggests accumulation by strategic investors, signaling sustained belief in Chainlink’s utility.

The network’s interoperability solutions are gaining significant traction, particularly in institutional adoption.

Chainlink’s interoperability layer is now powering Swapper Finance, enabling over 3 billion Mastercard holders to buy crypto on-chain via Uniswap, Shift4, Zerohash, and XSwap under Mastercard’s payment rails.

Meanwhile, JP Morgan–backed Kinexys Digital Payments leveraged Chainlink’s Cross-Chain Interoperability Protocol and Runtime Environment to execute the first cross-chain Delivery vs Payment between its permissioned rails and Ondo Chain’s testnet.

This was a landmark in institutional settlement for tokenized U.S. Treasuries.

Further reinforcing its infrastructure, Chainlink’s price feeds now support Ripple’s RLUSD stablecoin on the Ethereum mainnet, providing tamper-proof pricing data essential for DeFi stability.

Additionally, the Chainlink Runtime Environment, introduced in October 2024, is now piloting real-world asset settlements. CCIP remains live across Ethereum and multiple Layer 2 networks, powering seamless token and data transfers for next-generation DeFi and TradFi applications.

Underpinning these innovations, Chainlink staking contracts secure nearly $587 million in collateral according to DefiLlama, while over 21,000 addresses hold 94.28 million $LINK.

$LINK at Make-or-Break $13.60: Symmetrical Triangle Collides With Double Top

$LINK is currently trading at $13.59, consolidating within a symmetrical triangle after a rejection near $13.75 triggered a potential double top pattern. The structure reflects indecision as traders weigh bullish continuation against bearish exhaustion.

Technically, the triangle spans from the June 6 breakout rally, forming higher lows and lower highs, now compressing tightly below $13.60. The double top labeled “Top 2” remains a looming bearish signal, with the neckline aligning closely with the lower triangle boundary around $13.48.

Volume remains subdued, but the volume footprint reveals a tug-of-war.

Between 10:30 and 11:30 UTC, we observed a strong positive delta of +16.63K, primarily on the 10:15 candle, indicating aggressive bid-side interest. Yet, follow-up candles printed mixed delta and heavy ask absorption, especially at 11:00 (–6.06K), indicating a resistant ceiling near $13.60.

This indicates that buyers were aggressively bidding on the ask, a crucial bullish signal that shows intent to drive prices higher, but there was no subsequent continuation. What followed was ask-side absorption and a negative delta, showing sellers stepped in to defend the zone.

The RSI at 51.3 sits in neutral territory, reflecting the lack of momentum direction. Meanwhile, MACD is flatlined near the zero axis, suggesting the market is awaiting a catalyst.

A break below the triangle support and double top neckline opens downside targets at $13.10 and potentially $12.95.

A confirmed breakout above $13.75, accompanied by strong volume and a positive delta, could invalidate the bearish setup, potentially pushing the price toward the $14.20 region.

For now, the price action is coiled tightly, and volume signals are conflicted. Traders should await a clear break and follow-through before positioning.

The post $LINK Nears Explosive Move: Will $13.60 Breakout or Breakdown? appeared first on Cryptonews.

#LINK #Nears #Explosive #Move #Breakout #Breakdown

Chainlink's +11% price jump today comes as its amount of holders recently surpassed its all-time high, now up to 769,380. Additionally, wallets active in the past year are -17.3%, indicating its long-term investing timeframe is in an opportunity zone.

Chainlink's +11% price jump today comes as its amount of holders recently surpassed its all-time high, now up to 769,380. Additionally, wallets active in the past year are -17.3%, indicating its long-term investing timeframe is in an opportunity zone.