While Bitcoin hasn’t seen a direct rally from the Toronto Stock Exchange’s approval of 3iQ’s XRP ETF, the move is being viewed as a win for the entire digital asset space. The fund’s backing by Ripple and its fee-free launch make it accessible to a wider pool of institutional and retail investors.

Although XRP is the primary beneficiary, this regulatory milestone suggests growing acceptance of crypto ETFs beyond BTC and ETH. As more alternative coin ETFs enter the market, BTC is poised to benefit from increased investor trust and infrastructure development.

A more inclusive ETF environment signals a maturing asset class and paves the way for long-term capital inflows into BTC.

- XRPQ ETF launched by 3iQ, backed by Ripple

- First six months: zero management fee

- Cold-storage, regulated, and accessible to global investors

$90M Nobitex Hack Raises Security, Political Concerns

Iran’s largest cryptocurrency exchange, Nobitex, suffered a politically charged cyberattack, resulting in over $90 million in damages. The pro-Israel group Predatory Sparrow exploited internal access vulnerabilities and used politically suggestive wallet names, burning assets including $2M in BTC and over $49M in TRX.

While cold storage remains safe and Nobitex has promised to cover user losses, the hack serves as a stark reminder of cryptocurrency’s vulnerability in geopolitically sensitive regions. Despite the severity, the incident hasn’t spilled over into the broader Bitcoin market, signaling resilience among institutional holders.

- $90M burned: BTC, TRX among affected assets

- Nobitex suspends services, vows reimbursement

- Security concerns rise, but the BTC market remains stable

Prenetics Bitcoin Bet Signals Institutional Expansion

Adding a bullish layer to BTC’s macro narrative, Hong Kong-based healthcare company Prenetics has invested $20 million in BTC, acquiring over 187 coins at an average price of $106,712. The firm has brought on Trump-affiliated crypto strategist Tracy Hoyos Lopez and ex-OKEx COO Andy Cheung as it eyes deeper crypto integration.

With liquidity reserves of $117 million, Prenetics plans to expand its BTC holdings, signaling growing BTC adoption outside traditional financial circles. This move, aligned with pro-Bitcoin political sentiment, may help accelerate narratives of corporate and sovereign accumulation.

- 187 BTC acquired, avg. price $106,712

- Shares jumped 8.7% post-announcement

- New crypto advisors linked to Trump and OKEx

Bitcoin Technical View: Triangle Squeeze Into Key Decision Zone

Bitcoin is trading near $104,773, with technical compression forming between a rising trendline and the 50-period EMA ($105,529) that is descending. Three recent candles show lower wicks defending support around $104,000.

MACD is flattening, hinting at a possible bullish crossover. A breakout above $105,530 may open upside to $106,650 and $107,750. On the downside, a breach below $103,500 shifts focus to $102,180 and $100,450.

- Bullish trigger: Close above $105,530

- Bearish trigger: Break below $103,500

- Neutral momentum: Watch volume and MACD crossover

Currently, Bitcoin price prediction remains bearish with mixed catalysts as traders are watching for confirmation before taking directional positions.

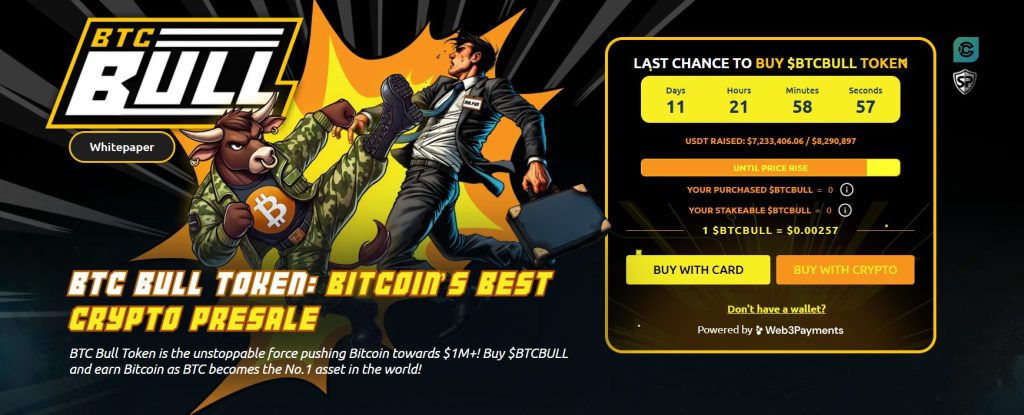

BTC Bull Token Nears $8.2M Cap as 58% APY Staking Attracts Last-Minute Buyers

With BTC trading near $105K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $7,233,406 out of its $8,290,897 cap, leaving less than $1 million before the next token price hike. The current price of $0.00257 is expected to increase once the cap is hit.

BTC Bull Token links its value directly to Bitcoin through two core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 58% APY staking pool holding over 1.81 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Faces Pressure, $90M Hack, $20M Buy: Finds Support appeared first on Cryptonews.

#Bitcoin #Price #Faces #Pressure #90M #Hack #20M #Buy #Finds #Support

Healthcare firm Prenetics buys $20 million worth of BTC and adopts

Healthcare firm Prenetics buys $20 million worth of BTC and adopts