Bitcoin faces a potential crash to $92,000 as demand metrics show alarming deterioration across multiple key indicators, with CryptoQuant’s head of research, Julio Moreno, warning that Bitcoin has entered a “soft patch” that could derail the current bull run.

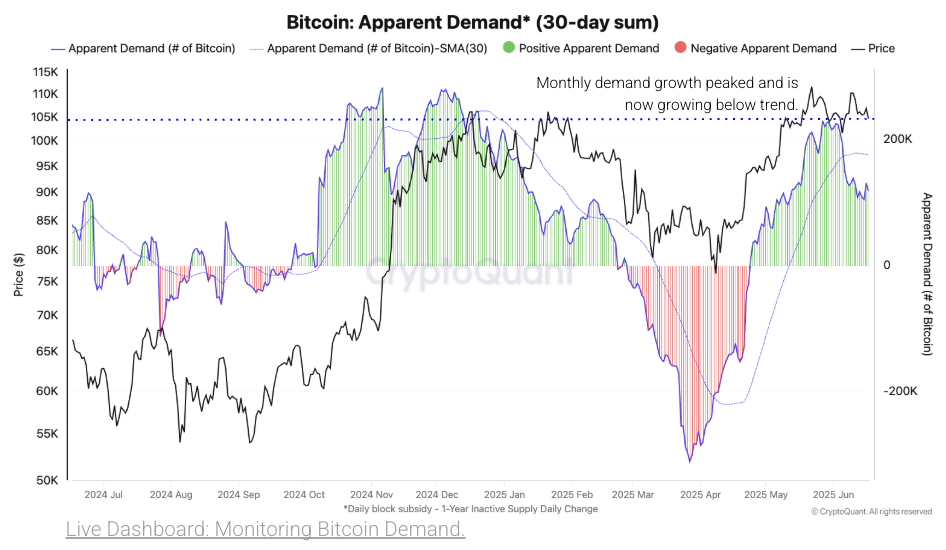

The sobering analysis reveals that apparent demand growth has plummeted by nearly 50% from its May peak of 228,000 BTC to just 118,000 BTC over the past 30 days.

This dramatic demand destruction comes as Bitcoin trades around $104,700, down 6.5% from its $112,000 peak in May, with short-term holders shedding 800,000 BTC since late May as new investor participation wanes and futures traders increasingly open short positions.

The demand crisis emerges despite Bitcoin maintaining what many analysts consider healthy long-term fundamentals. The cryptocurrency is still at only 4.7% global adoption, equivalent to internet adoption in 1999, suggesting massive untapped growth potential remains intact.

However, the immediate technical and fundamental picture presents concerning signals that challenge the sustainability of the current bull market phase. Futures data shows traders have shifted from profit-taking to actively opening fresh short positions as Bitcoin failed to hold above $110,000.

All of these create a perfect storm scenario that could trigger the deepest correction since Bitcoin’s ascent above $100,000.

The potential $92,000 target corresponds to CryptoQuant’s “Traders’ On-chain Realized Price,” a critical metric that has historically provided robust support during bull markets but could signal more severe weakness if breached.

This level would represent a 12% decline from current prices and nearly 18% from recent highs.

Institutional Exodus and Retail Capitulation Signal Demand Crisis

CryptoQuant’s analysis reveals a dramatic reversal in the institutional and high-net-worth demand that previously drove Bitcoin toward $112,000.

Whale accumulation has plummeted from 3.9% monthly growth in late May to just 1.7% currently, while U.S. ETF flows have collapsed 66% from peak daily purchases of 9,700 BTC in April to merely 3,300 BTC.

This institutional withdrawal signals that the sophisticated money driving sustainable rallies has stepped back from aggressive accumulation.

The retail capitulation is equally concerning, with short-term holders reducing their Bitcoin positions by 800,000 BTC since May 27. This cohort, representing new market entrants and momentum-driven buyers, has declined 15% from 5.3 million to 4.5 million BTC.

Since these participants typically provide the demand needed to absorb profit-taking from long-term holders, their withdrawal threatens to create a feedback loop where reduced buyer interest leads to increased selling pressure.

Despite positive developments like Arizona’s Bitcoin reserve bill and Prenetics’ $20 million investment, this demand destruction persists, suggesting that supportive news cannot overcome the underlying technical deterioration.

CryptoQuant’s futures market data confirms this bearish shift. Their Traders’ Behavior Dominance metric shows participants have moved from profit-taking after Bitcoin’s $110,000 peak to actively establishing short positions. This typically indicates growing confidence that further downside awaits.

Technical Analysis Reveals Critical Support Levels and Cycle Positioning

From a technical perspective, Bitcoin’s current position shows a longer-term bullish structure and near-term corrective pressure that could determine whether the $92,000 scenario materializes.

The weekly Wyckoff accumulation analysis suggests Bitcoin remains within the “Expansion” phase of a major market cycle, having completed what appears to be a five-wave Elliott sequence with potential targets in the $140,000-150,000 range if the pattern continues developing as anticipated.

However, the recent demand deterioration creates tension with this optimistic scenario, suggesting that Bitcoin may need to retest the “Manipulation” phase around $85,000-90,000 before resuming its advance.

The biweekly super cycle analysis provides crucial context by positioning Bitcoin within its established logarithmic growth channel that has guided price action since 2017.

Current trading around $104,700 places Bitcoin in the early-to-middle stages of its 2025 bull cycle. The asset has successfully broken above previous cycle highs and established new all-time territory.

The historical pattern overlay demonstrates remarkable consistency across different cycles, suggesting that while near-term corrections are natural and healthy, the longer-term trajectory remains intact with potential targets in the $200,000-300,000 range.

The hourly Elliott Wave structure provides the most granular view of immediate price action and reveals a complex corrective pattern that supports CryptoQuant’s bearish thesis.

The wave count suggests Bitcoin may have completed a primary five-wave advance and entered the early stages of an A-B-C corrective sequence. On weakening volume and momentum, the asset broke below key support around $107,000.

This micro-structure analysis indicates that sustained breaks below $100,000 could trigger algorithmic selling and accelerate the move toward the $92,000 target, representing completion of a larger degree wave two correction.

Overall, technical indicators show a high-probability scenario in which Bitcoin tests the $92,000 Traders’ On-chain Realized Price level, which has historically provided robust support during bull markets.

However, the longer-term cycle analysis suggests this potential correction would represent a healthy pullback within an intact bull market rather than a fundamental breakdown, potentially offering an attractive accumulation opportunity before the next major advance toward cycle highs.

The key inflection point remains whether Bitcoin can hold above $100,000 or if demand continues deteriorating sufficiently to trigger the deeper correction scenario.

The post Bitcoin Could Crash to $92K as Demand Drops 50%, CryptoQuant Warns – Is the Bull Run Over? appeared first on Cryptonews.

#Bitcoin #Crash #92K #Demand #Drops #CryptoQuant #Warns #Bull #Run

Arizona Bitcoin reserve bill HB2324 outlines three options for handling seized crypto assets, including storage in state-approved digital wallets.

Arizona Bitcoin reserve bill HB2324 outlines three options for handling seized crypto assets, including storage in state-approved digital wallets.