Technical resilience positions BCH to be a standout performer, and the near-term Bitcoin Cash price outlook appears poised to outpace Bitcoin itself in the coming weeks.

While the altcoin market has broadly softened amid U.S. trade uncertainty, a cooling labor market, and civil unrest in its largest economy, Bitcoin Cash remains strong

BCH has risen 7% over the past 30 days, despite the broader crypto market’s struggles with consolidation—grounds it could be among the best cryptos to buy in June.

Derivatives Traders Bet on Bitcoin Cash as Ecosystem Spikes

Despite prevailing headwinds, a surge in on-chain activity suggests rising user engagement and liquidity on the Bitcoin Cash blockchain.

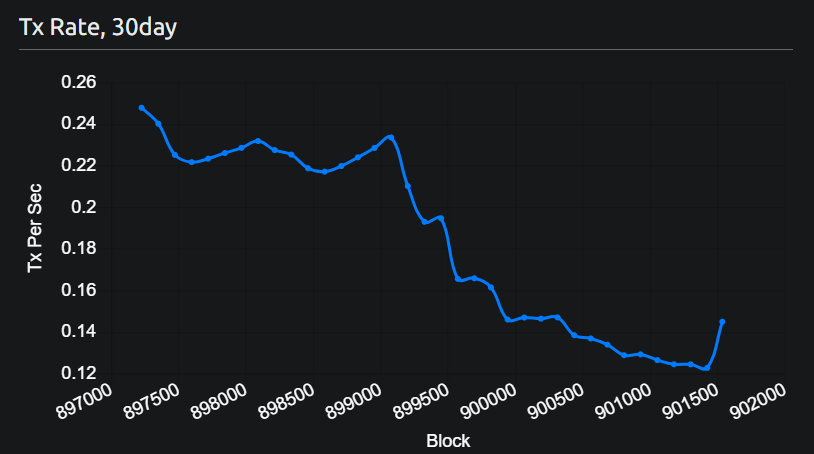

According to Bitcoin Cash Explorer, the 30-day transaction rate has sharply reversed its month-long downtrend, jumping to 1.4 tx/s—hinting at the early stages of a new uptrend.

A higher transaction rate often correlates with growing adoption and utility, both of which are key long-term price drivers.

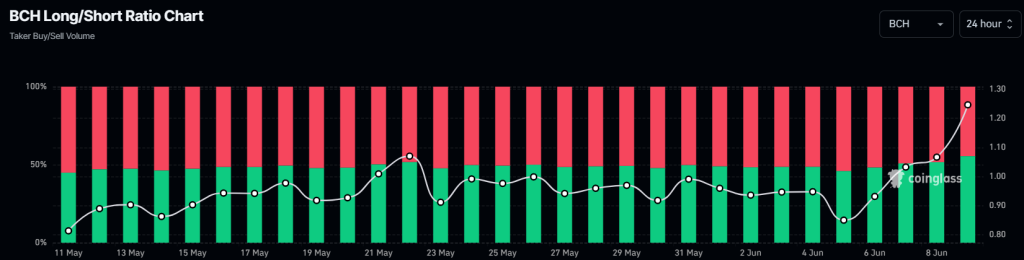

Derivatives traders seem to be positioning behind this development, with Coinglass reporting a 24-hour long/short ratio of 1.24—55% of traders are betting on a Bitcoin Cash price increase.

This renewed optimism follows the largest Bitcoin Cash liquidation event since April during Thursday trading, which saw $2 million in long positions wiped out.

Despite the flush, traders are now re-entering with conviction, suggesting confidence in a potential rally.

Bitcoin Cash Price Analysis: Is BCH Set to Outperform in June?

The month-long Bitcoin Cash uptrend represents a continuation of the March breakout from a falling wedge—a classic reversal pattern.

Though post-breakout momentum initially faltered, the mid-April market bottom proved pivotal, kickstarting a new higher-high, higher-low structure that has since formed a broadening wedge.

Following a successful bounce from its lower support, the next higher high could deliver a 30% rally toward $547.50—aligned with the 0.236 Fibonacci extension.

This bullish continuation seems credible with a sharp uptrend in the RSI from 50 to 60—a sign that the bounce is backed by substantial buying pressure, overwhelming sellers.

However, caution remains warranted. The MACD line is moving in close parallel with the signal line, teetering on the edge of a potential death cross. This bear flag typically signals the start of a new downtrend.

If Bitcoin Cash breaks this uptrend in a move below $400, the bullish setup could be invalidated. In the case of a breakdown, immediate support lies at the 50EMA for a potential false breakdown.

Bitcoin Could Still Have an Edge, With Some Help

Those who jumped to Bitcoin Cash over the original may be forced to reconsider as the Bitcoin ecosystem finally addresses its biggest limitation: scalability.

Slow transactions, high fees, and limited programmability have held it back from competing with Ethereum and Solana—until now.

And this shift starts with Bitcoin Hyper ($HYPER), Bitcoin’s first real-time Layer 2 that brings Solana-level speed and smart contracts directly to the Bitcoin ecosystem.

Powered by the Solana Virtual Machine (SVM) and anchored by a decentralized Canonical Bridge, it enables fast, cheap, and composable dApps—all while staying secured by Bitcoin.

With over $800,000 in its first presale week, investors are already rallying behind $HYPER, potentially credited to its huge 916% APY on staking that rewards early investors.

You can keep up with Bitcoin Hyper on X and Telegram, or join the presale on the Bitcoin Hyper website.

The post Bitcoin Cash Price Prediction: Traders Bet on BCH to Outperform Bitcoin in June appeared first on Cryptonews.

#Bitcoin #Cash #Price #Prediction #Traders #Bet #BCH #Outperform #Bitcoin #June