Spain’s second-largest financial institution, BBVA, has introduced Bitcoin and Ethereum trading and custody capabilities for retail customers, marking a significant expansion of regulated digital asset services across Europe.

BBVA has fully integrated these cryptocurrency services within its proprietary mobile platform, operating independently without relying on external service providers or third-party custodial solutions.

The bank’s approach allows customers to execute transactions autonomously while maintaining that it does not offer investment advisory services.

BBVA’s 4-Year Crypto Journey Reaches Spain

According to an official release dated July 4, the cryptocurrency service launch stems from regulatory approval obtained through Spain’s National Securities Market Commission (CNMV) in March 2025.

This licensing framework authorizes BBVA to provide cryptocurrency services to all customers who meet legal age requirements.

“Our objective is to simplify cryptocurrency investment for retail customers in Spain through an accessible and user-friendly digital platform available on their mobile devices,” stated Gonzalo Rodríguez, BBVA’s head of retail banking for Spain.

The service architecture ensures compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulation, which establishes comprehensive standards for cryptocurrency-related services across EU member states.

BBVA’s Spanish cryptocurrency initiative builds upon the success of its Swiss operations. In June 2021, BBVA Switzerland pioneered the bank’s cryptocurrency offerings by introducing Bitcoin custody and trading services for private banking clientele

The Swiss division has since diversified its cryptocurrency portfolio to encompass Ethereum, Solana, XRP, and AVAX, successfully attracting both institutional investors and high-net-worth individuals.

Recent reports from June 18 indicate that BBVA has been recommending portfolio allocations of 3% to 7% in cryptocurrencies for its affluent clients.

Philippe Meyer, head of digital and blockchain solutions at BBVA Switzerland, indicated that the bank currently advises clients to focus on Bitcoin and Ethereum investments, with plans to introduce additional cryptocurrencies later this year.

“A 3% portfolio allocation to cryptocurrency represents manageable risk exposure,” Meyer explained. “In a balanced portfolio structure, introducing 3% cryptocurrency allocation can enhance overall performance.“

Expanding Stablecoin Services See 9% of Spaniards Own Crypto, While 95% of EU Banks Stay Away

Beyond Bitcoin and Ethereum, BBVA has incorporated USDC stablecoin services into its offerings. In September 2024, the bank extended its cryptocurrency custody and trading capabilities to include USD Coin for institutional and private banking clients in Switzerland.

This expansion enables clients to trade, hold, or convert USDC into euros, dollars, or other currencies with near-instantaneous execution.

The bank noted that investment fund managers and large corporations frequently utilize stablecoins like USDC to accelerate transactions across various cryptocurrency exchanges.

Additionally, stablecoins serve as a hedge against cryptocurrency volatility by allowing investors to preserve asset value during market fluctuations.

Despite approximately 95% of EU banks avoiding cryptocurrency services due to the European Securities and Markets Authority’s (ESMA) cautious regulatory stance, Spain’s cryptocurrency market has demonstrated substantial growth.

A 2024 European Central Bank survey, published in January 2025, revealed that nearly 9% of Spanish citizens now hold digital assets, representing more than double the figure from 2022.

Spain’s cryptocurrency adoption rate now equals that of France and Croatia within the Eurozone, though it remains below Slovenia’s 15% adoption rate and Greece’s 14% ownership levels.

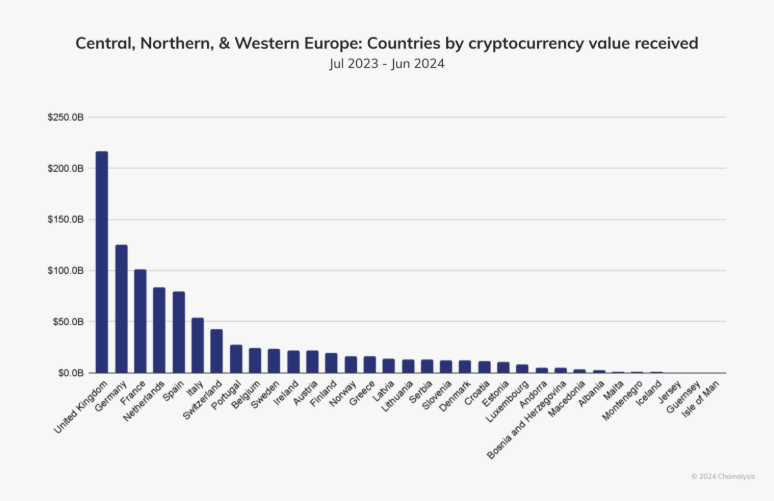

Between 2023 and 2024 alone, Spain received over $80 billion worth of cryptocurrency, making it the 5th largest European country with the most crypto value received.

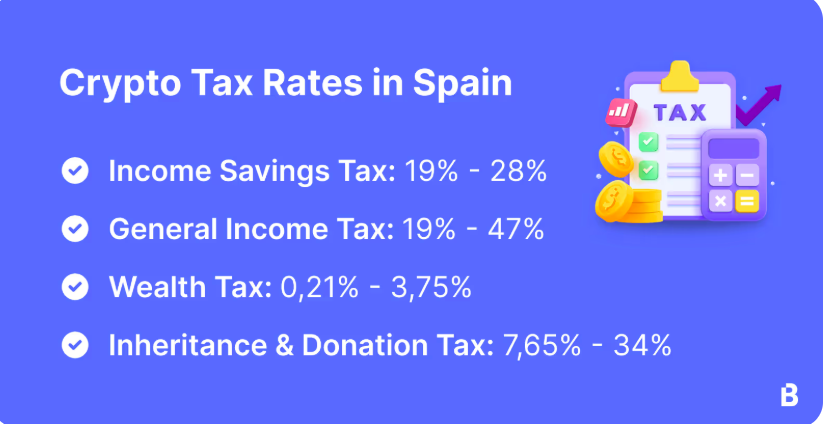

Despite growing adoption, Spain has tight tax regulations on crypto.

The Spanish cryptocurrency taxation follows specific guidelines established by the Spanish State Agency for Tax Administration (AEAT). Spanish residents are required to declare gains from cryptocurrency transactions and income generated from digital asset holdings or related activities.

Spanish taxpayers are required to report cryptocurrency gains exceeding €6,000 under the Income Savings Tax (Capital Gains Tax), with rates ranging from 19% to 28% depending on total gains.

The post Spanish Banking Giant BBVA Expands Crypto Offerings with Bitcoin and Ethereum Services appeared first on Cryptonews.

#Spanish #Banking #Giant #BBVA #Expands #Crypto #Offerings #Bitcoin #Ethereum #Services

Spanish lending giant BBVA said it won approval to launch Bitcoin and Ether trading, integrating crypto into everyday banking.

Spanish lending giant BBVA said it won approval to launch Bitcoin and Ether trading, integrating crypto into everyday banking. (@DocumentingBTC)

(@DocumentingBTC)