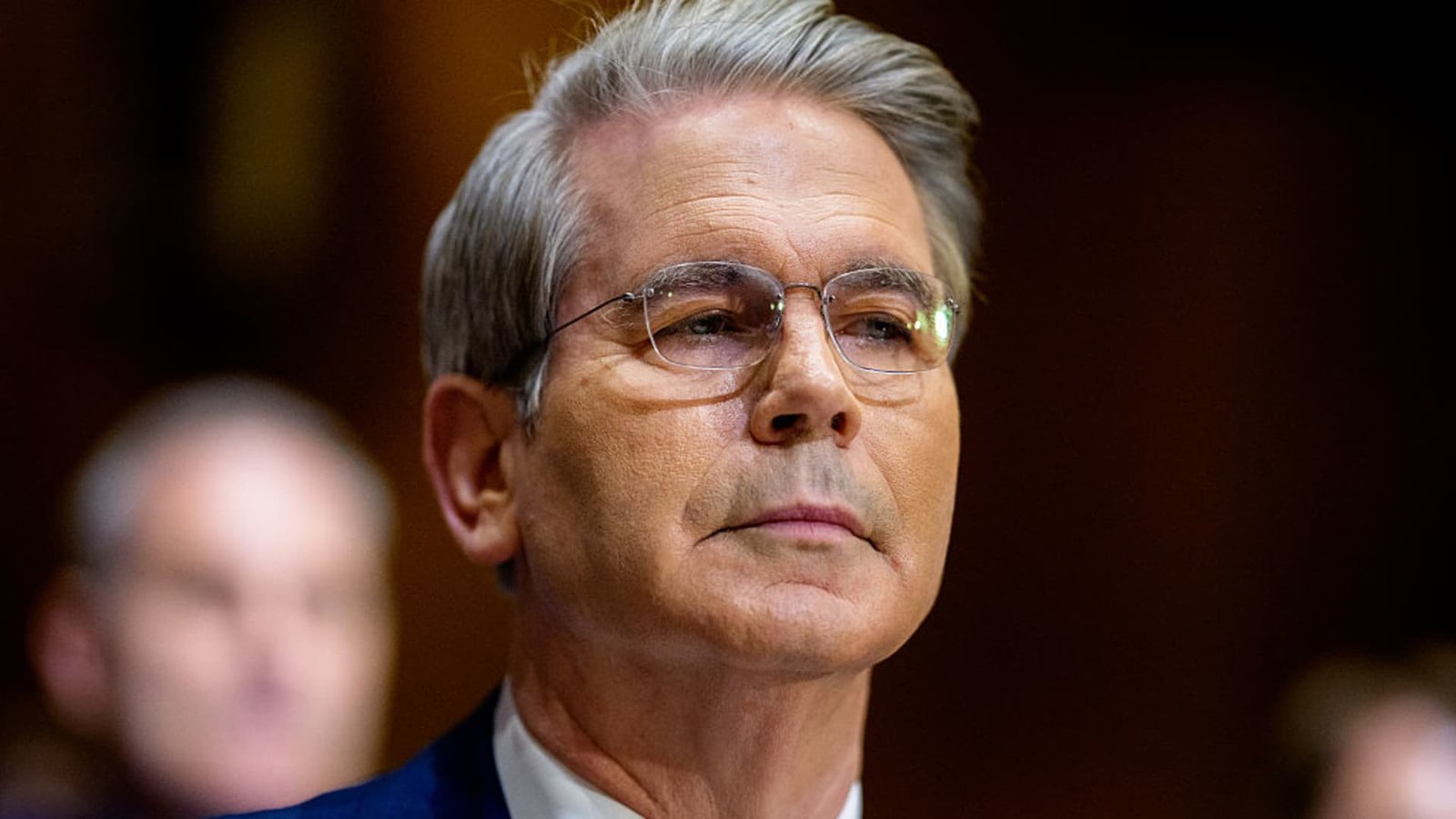

The crypto industry is on the verge of a major regulatory milestone, and it could lead to digital assets being a significant source of funding for the U.S. government. On Tuesday, the Senate passed the GENIUS Act , which lays out a regulatory framework for stablecoins, sending it on to the House of Representatives with bipartisan support. Treasury Secretary Scott Bessent praised the bill in a post on X , saying that a regulated and growing stablecoin market could create new buyers for U.S. government debt. “A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt. It could also onramp millions of new users — across the globe — to the dollar-based digital asset economy,” Bessent said. “It’s a win-win-win for everyone involved” The exact size the stablecoin market can reach in the future is unclear, but it does appear that the U.S. government will have plenty of debt to sell to it. The Congressional Budget Office’s dynamic score — which takes into account the legislation’s potential changes to factors like economic growth — said the tax and spending bill that recently passed the House would increase the total deficit by $3.4 trillion from 2025 to 2034, including interest costs. The current size of the U.S. dollar-denominated stablecoin market is around $230 billion to $250 billion, according to Robbert van Batenburg, strategist at The Bear Traps Report, and there is a theory that a clearer regulatory framework can help lead to wider adoption. Several major tech and consumer companies are reportedly exploring issuing their own stablecoins or using existing coins more frequently. Bessent previously told the House Financial Services Committee in May that there is “speculation” the stablecoin market could be “up to $2 trillion of demand over the next few years for U.S. government securities from digital assets.” The market could in theory surpass that $2 trillion figure if stablecoins start to take market share from traditional credit card payment networks, van Batenburg said. The stablecoin bill also comes at a time when Wall Street has started to fret about foreign investors and governments turning away from U.S. assets. Katie Haun, founder and CEO of Haun Ventures and former Coinbase board member, said Friday on ” Squawk Box ” that the stablecoin industry is already 14th largest holder in the world of U.S. Treasurys, ahead of nations like Germany and Norway, and that the new legislation should help it continue to grow. “I’ve been asking for regulatory clarity and more rules of the road, and I think the GENIUS Act is exactly that,” Haun said. How stablecoins work Stablecoins are a type of digital currency that is often used to facilitate crypto trading but can also work for other types of transactions. They are designed to be “stable” at a set value. Some stablecoins have drawn scrutiny in the past over concerns that their reserves were insufficient or relied on mechanisms that would unreliable in times of market stress. The Senate bill calls for stablecoins to be backed on at least a 1-to-1 basis by highly liquid assets, including U.S. currency, U.S. Treasury bills, repurchase agreements — or “repos” — backed by Treasury securities, government money market funds and central bank reserve deposits. An example of a stablecoin’s reserves can be found in the disclosures from Circle , which went public earlier this month and has seen its stock soar . CRCL 1M mountain Shares of Circle have soared since the IPO. Circle’s IPO prospectus shows that the vast majority of its stablecoin reserves are held in a BlackRock vehicle called the Circle Reserve Fund . That fund’s holdings are split roughly 50-50 between short-term U.S. Treasury Debt and Treasury repurchase agreements. If the GENIUS Act is enacted as currently written, stablecoin companies will be required to certify they have these holdings on a monthly basis, with the oversight of registered public accounting companies. Risks A growing stablecoin industry in the U.S. is not likely to completely fix the government’s debt funding problem, and it could introduce additional risks. Nonprofit group Better Markets opposes the GENIUS Act, and its policy director Amanda Fischer said in a statement that the bill ignores “the susceptibility of stablecoin companies to runs, bankruptcies, and taxpayer-funded bailouts.” Counting on the industry as a funding source for the Treasury market could also be tricky. Lawrence McDonald, founder of the Bear Traps Report, cautioned that additional demand from stablecoins will take time to develop while the U.S. Treasury will likely need to issue significant amounts of debt securities over the next year. McDonald also said that, while interest costs of short-term debt are cheaper than that of 30-year Treasurys, relying so heavily on the short-end of the bond market can be a problem for countries. “If something ever went wrong, in terms of say oil, and that prevented the [Federal Reserve] from cutting, then you’re going to have a high bill rate for a long-time and the deficit is going to spiral out of control,” McDonald said.

#stablecoin #bill #Treasury #Secretary #Bessent #tool #fund #U.S #deficit