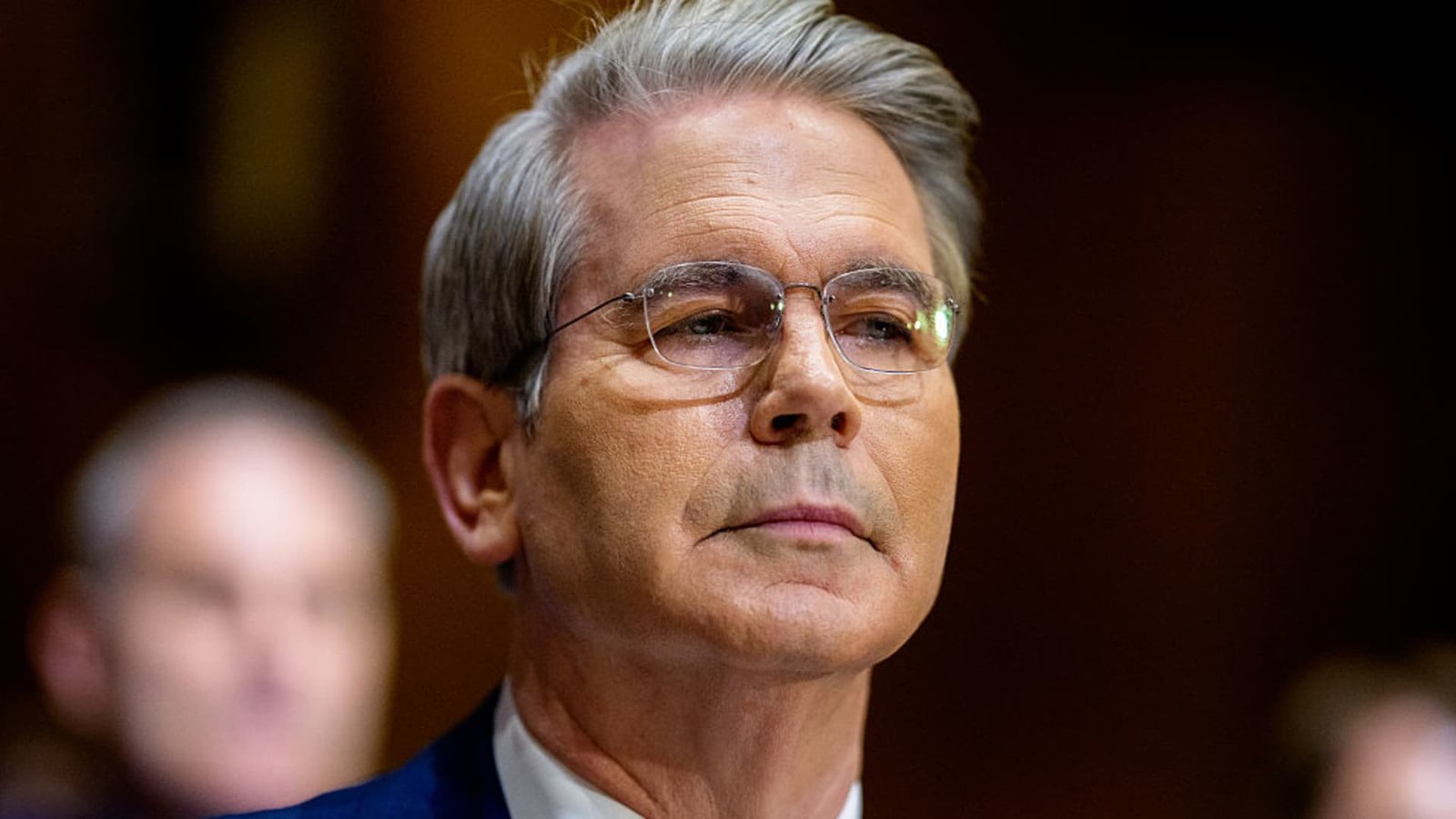

US Speaker of the House Mike Johnson, Republican from Louisiana, speaks during a news conference after a House Republican conference meeting on Capitol Hill in Washington, DC on June 4, 2025.

Saul Loeb | Afp | Getty Images

Republicans’ One Big Beautiful Bill Act could result in higher monthly payments for many federal student loan borrowers, a new analysis finds.

If the legislation is enacted as drafted, a student loan borrower earning roughly $80,000 a year (the median for a bachelors’ degree holder in 2024) would have a monthly payment of $467 under the GOP-proposed “Repayment Assistance Plan,” or RAP, according to recent findings by the Student Borrower Protection Center. That compares with a $187 monthly bill on the Biden administration’s now-blocked SAVE, or Saving On A Valuable Education plan.

No matter their income, borrowers face higher monthly payments under RAP compared with SAVE, the analysis found. For lower incomes, the difference may be just $10 per month; for higher earners, the new repayment plan can be as much as $605 per month pricier.

Depending on their income, some federal student loan borrowers also face higher payments on RAP than they would have on the U.S. Department of Education’s other income-driven repayment plans, including PAYE, or Pay As You Earn and IBR, or Income-Based Repayment.

However, some borrowers on PAYE or IBR plans would have a smaller bill under RAP. For example, a borrower with a roughly $60,000 annual income would pay $250 a month on RAP, and $304 on PAYE, the SBPC found.

The House advanced its version of the One Big Beautiful Bill Act in May. The Senate Committee on Health, Education, Labor and Pensions released its budget bill recommendations related to student loans on June 10. Senate lawmakers are preparing to debate the massive tax and spending package.

Financial Advisor Council.

There’s also “an emotional toll” to carrying student debt for so long, said Cathy Curtis, the founder of Curtis Financial Planning in Oakland, California. She is also a member of CNBC’s Financial Advisor Council.

“It reinforces the feeling of being stuck — especially for those who’ve already struggled to access opportunity,” Curtis said.

shift student debt onto taxpayers that chose not to go to college,” Cassidy said in a statement on June 10.

He said his committee’s bill would save an estimated $300 billion out of the federal budget.